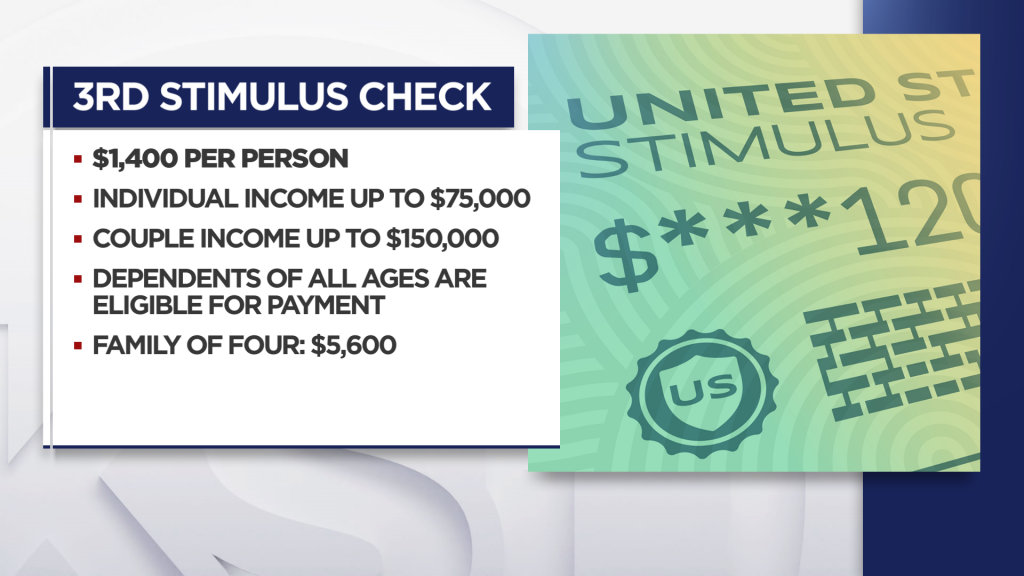

Watch this: Stimulus check 3: How much money you'll getĠ2:32 Don't throw away the IRS letter about your stimulus payment

IRS GOV 3RD STIMULUS CHECK TRACKING HOW TO

So what to do instead? Our guide walks you through how to report stimulus check problems, including checks that never arrived (try filing a payment trace), direct deposit payments that went to the wrong account and other issues. The IRS doesn't want you to call if you encounter a problem with the delivery or amount of your stimulus check. How to notify the IRS of an issue with your check Tax nonfilers may need to be proactive about claiming a new dependent, too. In other words, individuals who experience homelessness or make little or no income can use this tool to enter their personal details for the IRS' records so as to receive the $1,400 stimulus checks or claim the recovery rebate credit for any amount of the first two rounds of payments that might have been missed. However, the tool is also for those who did not file either a 2019 or 2020 tax return and did not use the previous nonfilers tool last year to register for stimulus payments. You may be eligible to claim the 2020 Recovery Rebate Credit for claiming missing money from the first two checks.Īlso, last week, the IRS launched a new online for familes that don't file taxes called the " Non-filer Sign-up Tool." Its purpose is to help eligible families who don't normally file a tax return enroll in the monthly child tax credit advance payment program, which is slated to begin July 15. We suggest making sure you know how to find out your adjusted gross income. For money missing from the first two checks, you need to claim that on your 2020 taxes. Plus-up payments are going out weekly along with the third round of checks, but they may not be the only money you're due. What to do if you're missing money from the first two stimulus checks If not, you might have to wait until you file your 2021 taxes in 2022 to claim it - even if you're a nonfiler who isn't typically required to file taxes. The IRS could open up claims for missing stimulus money before its Dec. If you had a baby or otherwise added a dependent in 2020, you won't need to file an amended tax form to claim the supplement. Remember the IRS is automatically sending plus-up payments after the agency receives your 2020 tax return.

So what happens if you use our stimulus check calculator and notice the numbers seem way off, or the IRS letter quotes an amount you didn't receive? Start by triple- checking your qualifications to make sure you're eligible for the total you expect. Through the debate in Washington over additional economic impact payments continues, it's looking increasingly unlikely that there will be any more direct payments this year. In a press conference on June 3, White House press secretary Jen Psaki played down the possibility of a fourth check, asserting that the administration has already put forward an economic recovery plan. But President Joe Biden hasn't pledged support to a fourth check, focusing instead on his proposed family and jobs packages and the recent infrastructure deal. Millions have been clamoring for recurring stimulus payments, and some lawmakers have expressed support for more relief aid through the pandemic.

You receive SSDI or SSI benefits or veterans' benefits and your check hasn't shown up.There was a calculation error and you need to claim an adjustment or wait for a plus-up payment.

0 kommentar(er)

0 kommentar(er)